By Michael Ibonye

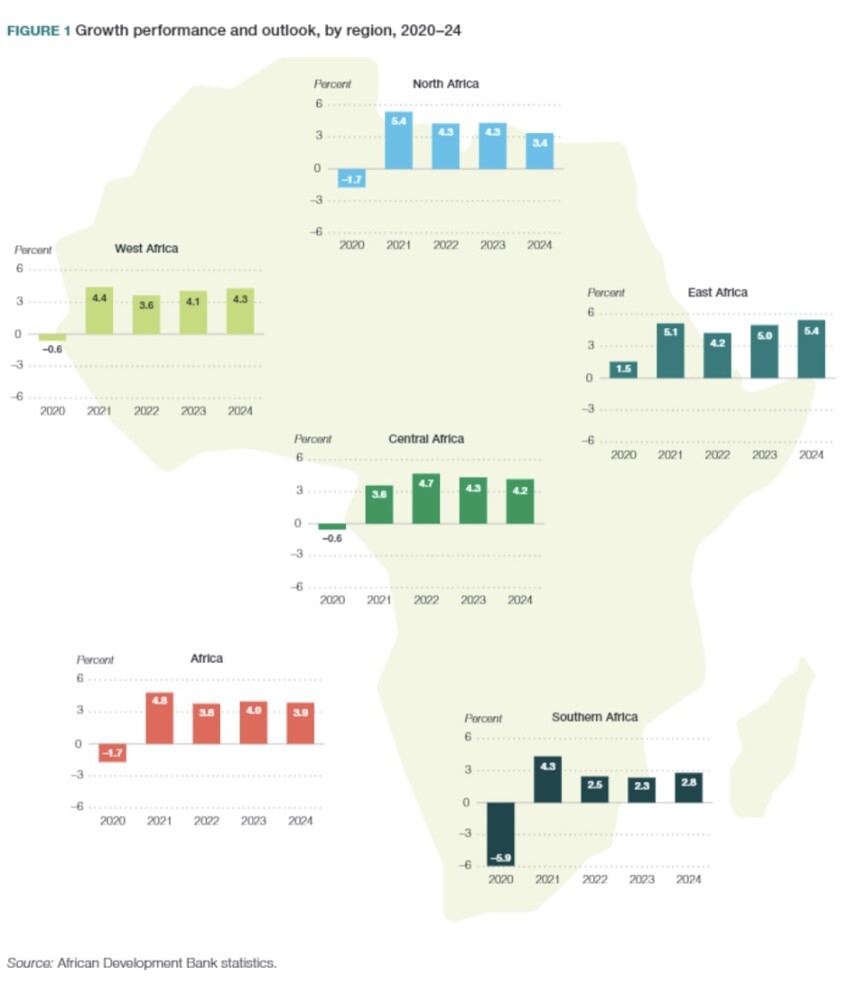

The global economy has been through challenging times in the last few years. Market conditions have changed significantly, driven first by COVID-19 and then the Russo-Ukrainian war. Consequently, inflation has been on the rise across the world, driven partly by supply chain snags, trillion dollar stimulus packages, and the tussle for talent. Fluctuating fiscal policy appears to be the norm across the globe as capital becomes scarcer to access, and consumers hold on tightly to their cash. While it may appear all doom and gloom, businesses across the world continue to grow their revenues, expand their customer base and achieve record profits. In this VUCA (Volatility, Uncertainty, Complexity, Ambiguity) climate, businesses are taking advantage of opportunities present in Africa as a new frontier for growth, with some announcing new investments to grow and expand on the continent.

Both businesses with existing operations on the continent as well as others seeking new growth opportunities could benefit from taking a closer look at Africa expansion opportunities. With a population of over 1.4 billion people, around 60% 24 years old and under, a GDP of $3.1 trillion, and a literacy rate of 67%, Africa has the markings of a market with high growth potential.

Africa’s Growth Performance and Outlook

Companies deciding to plant or deepen their roots in Africa or African companies looking to expand globally can consider multiple models of expansion. This paper will share examples of these models that could each be relevant to existing or new businesses, some key considerations for businesses thinking about expansion, and some insights for selecting expansion markets. Additionally, the paper will explore the expansion journey of Tyms Africa – an innovative fintech company driving financial inclusion by helping small and mid-sized enterprises in Africa save money and scale faster through its finance and accounting automation platform.

Indicators for expansion readiness: When is expansion right for your enterprise?

Determining the right time to expand to a new market can be a challenging decision to make for business leaders. Expansion often requires significant resources and there are no guarantees of a breakthrough. Yet, there are some positive indicators that can inform leaders that their business is ready for expansion. The top three indicators are customer loyalty, operational capacity, and financial security.

- Customer Loyalty: Customers have become fans of your product/service. This is perhaps one of the most crucial indicators to look out for. How happy are your customers? What are they saying about your product/service? This is one way for a business to determine if it has found product-market fit. So before thinking about making that additional investment to expand the business, talk to customers first. The Net Promoter Score (NPS) is a reliable approach for measuring customer loyalty towards products and services. Customer satisfaction can indicate whether the enterprise is ready to expand, as scaling an unpopular product or service will likely waste critical resources.

- Operational Capacity: There is available operational capacity to scale quickly and sustain. How easy is it for your enterprise to go from making 100 units of a product or serving 100 customers to making 1,000 units or serving 1,000 customers? To adequately assess a business’ to answer these questions requires greater complexity than simply budgeting for more labor and capital. Organizations are a combination of intricate, interconnected systems providing services along a value chain. Changing one aspect of that value chain, without proportionately adapting all other systems, will lead to a system failure.

Let’s look at a restaurant scenario, say a restaurant has a very high NPS and so decides to explore expansion. If the managers focus heavily on finding a new location, hiring staff, and advertising, but pays little attention to how it will manage sourcing of produce for the new location or the quality of staff being hired, the restaurant will likely lose the secret sauce that drove its high NPS. Their incomplete expansion plan may end up losing customers not only in the new location but even at the existing one.

Businesses must consider all aspects of both internal and external capacity and adequately replicate them to expand successfully. Organizations will also do well to pay attention to opportunities to leverage technology in the expansion process. For example, adopting the use of an ERP (Enterprise Resource Planning) solution can help drive efficiency for a restaurant chain. An ERP can help create a single view for inventory and vendor management making it easier to manage suppliers across multiple locations. A finance and accounting automation software like Tyms Book can also make managing large transaction volumes across multiple locations seamless.

- Financial Security: The financial resources required to build and sustain the support structure for expansion is secured. Expansions typically require a significant amount of financial resources to capture a high potential market and turn it into a high value market over an extended period of time. It is what some might call patient capital, which is essentially a financial investment that prioritizes long term sustainable growth and returns over short-term returns. Regardless of how thorough an expansion plan an enterprise develops, it may still experience false starts and hiccups in its execution due to sudden market shifts that could not have been predicted. For example, a restaurant specializing in chicken-based menu items might expand just before a sudden bird flu epidemic and now faces a huge dip in patronage due to customer’s health concerns. Ultimately, all things equal, the market will rebound and the enterprise will recover, but the business will rely on patient capital to stay above water during the sudden market shift. Patient capital provides the funding runway to keep the lights on.

Only when all three indicators are flashing green can an enterprise proceed to expand, in addition to other industry-specific nuances.

Business expansion models: How will your business expand?

After paying attention to the above indicators and determining that expansion is right for your business, the next important question to answer becomes – how will expansion happen? Here are some potential ‘hows’ to be considered:

Segment expansion – Serving a new customer with a modified or new product. This model of expansion rests on the customer pyramid model (Figure 1.2) widely used by businesses. In this expansion model, a business is looking to cross over into one or more of the pyramid’s segments with an existing product, with the goal being to grow the business by expanding its customer base by serving new segments. For example, a furniture making company currently serving the middle of the pyramid (IKEA goers) may choose to grow by expanding to serve either the top of the pyramid (Pottery Barn goers). To do so will often require that the company designs a new product that fits its target segment or offer some Value Added Services (VAS) to an existing product that makes it more attractive to a new customer segment. A business might consider this model of expansion for a number of reasons, top of which might include: the business has not found product/service market fit in its segment, thinning margins in serving its segment, hyper competition in its segment making for a highly saturated market with little room for differentiation, or its current segment is fully served.

Geographic expansion – Serving customers within the same market segment, with the same product, but in new locations. This expansion model is likely top of mind for many in business whenever the topic of expansion comes up – and for good reason. If a business has already achieved product/service market fit, has very high margins, has ample room for growth in its segment, and is a top player within its current segment, then it makes sense that the ideal direction for expansion is to reach as many customers as possible by seeking customers in new locations. This approach is most attractive for businesses that have a winning product with broad appeal and have gotten their operations down to a science such that it is easy to replicate. This model of expansion is commonly used in the restaurant sector where the products are typically tailored to a specific segment of the market. Pursuing segment expansion in sectors such as these will most likely result in an entirely new business model. Hence, the path to growth often lies in becoming operationally excellent so that more customers within the target segment can be reached.

Product expansion – Serving an existing loyal customer base with new products. Businesses may seek to grow by developing new products that meet the needs of the existing loyal customer base. Such businesses are likely serving a segment of the market exceptionally and have built a sufficient level of customer loyalty. This expansion model offers businesses a less risky growth pathway, as loyal customers will very likely buymore products from the business and even offer feedback on new product ideas. Repeat buyers who provide feedback are invaluable to businesses in the ideation and experimental phase before deciding to make huge investments in new product development. Without a loyal customer base and a mechanism to acquire honest feedback about experimental products, it might be too costly for a business to explore this model. This is a model that could also work well in the restaurant business. A restaurant could pre-test a new menu item with its loyal customer base, launch the item, generate increased revenue from already loyal customers, and grow the loyal customer base by winning over customers with the new product.

The most ideal model for a business depends on many factors, some of which could influence a business to adopt a hybrid of two or three of the expansion models discussed above. Ultimately, whichever expansion model a business decides to pursue, each holds significant growth potential that businesses can tailor to their needs.

Choosing a suitable expansion model: Which expansion model is right for my enterprise?

After a business decides to expand, it will then ask: Which expansion model is right for my enterprise? The answer depends on enterprise-specific criteria for choosing an appropriate expansion model. These criteria include risk appetite, its current market, and the attractiveness of the opportunities along its value chain. Some sample criteria to consider are:

- Market size – Market size of all segments is a quantitative indicator for understanding the significance of the opportunity available for expansion. For example, a footwear company that has exhausted the middle of the customer pyramid may choose to explore segment expansion to the bottom or top of the pyramid by tweaking its product delivery based on where it can more easily achieve product-market fit and capture more value. To do so it must know the size of the available market in these segments. Alternatively, it may choose to expand within the middle of the pyramid but in a new geographic location, even then, quantifying the market size of the middle segment in the new location is crucial.

- Ease of doing business advantage – This criterion is especially important for businesses considering geographic expansion. When looking to expand geographically, businesses should pay attention to locations where comparative advantages exist in sourcing of input materials, trade policies, access to talent, technology, infrastructure, proximity to customers etc. The global ease of doing business ranking is a useful resource for this.

- Loyal customer base – If a business has an existing loyal customer base and is able to develop a new and unique product or service offering that meets the needs of those customers then it might consider a product expansion strategy.

The expansion Journey of Tyms Africa: From Lagos, Nigeria to the World.

Tyms Africa began its journey in the fintech space in 2021, when it launched its first product – a digitized version of the widely popular ROSCA (Rotating Savings and Credit Association) model. This innovative model was delivered to users via a web and mobile app called, “Ajo Money”. Following its product launch, Tyms focused on refining the product, growing its user base and revenue. They were not initially focused on expansion.

One year post-launch, Tyms co-founders received calls from Rwanda and Uganda, requesting their product. The prospect of expanding to new geographies was exciting to the co-founders, but having been operational for only a short while, they were not sure they were ready. One of the co-founders said, “The startup that wins is the one that grows fast and executes fast,” coming to that realization spurred them to pursue the expansion opportunity. In their minds, the expansion would help the company grow market share, diversify revenue base, increase valuation and make the company more attractive to the buy-side in a potential exit scenario.

While expansion seemed like a nice idea, there were two main obstacles to overcome. First, they needed to navigate the regulatory landscape of the target markets. They faced significant regulatory hurdles such as receiving deposits.Second, they needed to recruit and train a team that could understand and sell the product. After evaluating the opportunities and potential obstacles in the potential markets, Rwanda and Uganda, and considering the company’s readiness to pursue expansion efforts, the co-founders decided to expand to Uganda.

Recalling that first foray to a new geography, one of the co-founders reflects, “Despite the challenges that entering a new market brings, we were able to do it as a young startup because we had the key human resources on the ground, who had local context and understood the market. So we avoided some costly pitfalls”. She continued, “We also built our product with scale in mind. The ROSCA system is broadly understood across most of Africa so we did not have to do much in terms of explaining the product, and we had built-in features such as support for different currencies into the enabling technology, which made it broadly applicable”.

This year, the team at Tyms have built and launched a new product – an automated accounting software that they hope will become the most preferred and most used accounting software for businesses in Africa. Already this new product is available globally and has paying customers in Togo, Ghana, Cameroun, Mauritius, Nigeria and the United States. The lessons learned from scaling its first product came in handy in building and rapidly scaling a new one. Having key human resources on ground across key expansion locations is one of such crucial lessons. Tyms has built a network of partners across Uganda, Ghana, and Mauritius to drive the adoption of its SaaS (Software as a Service) accounting product. A second key lesson from scaling its first product was the importance of building with scale in mind. As a result, the enabling technology of the new product ensures that it is globally accessible, and can be easily deployed Out of Box (OOB) with minimal customization.

Conclusion

Achieving growth for an enterprise requires more than operational excellence. The enterprise must think strategically about how it aims to position for growth. The insights shared in this paper can serve as a starting point. An important first step to take on this journey is to evaluate the enterprise desiring growth against the three indicators of expansion readiness discussed earlier in the paper: customer loyalty, operational capacity, and financial security. Africa holds vast opportunities to invest as many sectors, from transportation to energy, remain in their early developmental stage. The continent is practically a greenfield investment destination ready for an influx of capital to cultivate it. As with any investment opportunity there are challenges to overcome, especially around regulation and infrastructure, but those challenges are themselves opportunities for growth and value capture.

About:

In this white paper Baobab’s Strategic Advisor, Michael Ibonye, writes about strategies for global businesses to explore expansion to Africa. “With a population of over 1.4 billion people, around 60% 24 years old and under, a GDP of $3.1 trillion, and a literacy rate of 67%, Africa has the markings of a market with high growth potential.” He shares insights for enterprises seeking growth to both create and capture value on the continent.

Michael Ibonye is a management consultant that focuses on helping businesses define their strategy, manage change, design optimal structures and processes for top performance. He has experience working in private and social sector settings, covering the financial services, technology, manufacturing, education and development sectors. Michael is passionate about development and supporting start-up ideas that create positive social and economic impacts.